AWASIOR

Known

- Messages

- 397

- Reaction score

- 95

- Points

- 28

What is DeFi?

What is DeFi? Why should I care? What are some examples of DeFi? Read on to find out.DeFi (which is short for Decentralized Finance), and alternatively known as Open Finance, refers to the ecosystem of open source protocols that provide permissionless financial services - meaning that anyone anywhere can access financial services (such as a USD savings account) without having to rely on a trusted third-party.

Not just that, but because DeFi projects are striving to be decentralized, more power is placed into the hands of users to develop these protocol, encouraging collaboration between stakeholders and introducing interesting incentives to draw in new users.

How is it possible to replace the middlemen and intermediaries of the traditional world of finance? Smart contracts on the blockchain!

Let's break down these two terms, 'smart contracts' and 'blockchain', for those that are not familiar:

- A ‘smart contract’ is a programmable contract that allows two counter-parties to set the conditions of a transaction without needing to trust a third party for the execution.

- A 'blockchain' is a digital ledger, containing the entire history of transactions and the state of contracts. Blocks are produced sequentially (on average every 10 seconds for Ethereum) and ordered chronologically, building on the previous history/state. The blockchain is updated collectively by miners/validators as new transfers are made, and new blocks are added to the chain. Once transfers are etched into the blockchain, they are immutable, since previous blocks cannot be re-written or replaced. Since Ethereum is a 'public blockchain', it is transparent and anyone running a node can verify any transfer for themselves.

Simply known as DeFi, it has been one of the most exciting and notable trends in the cryptocurrency scene for the past few years. While Ethereum accounts for the lion's share of DeFi activity, other smart contract platforms are also getting in on this trend, such as Avalanche, Tron, Waves and more.

Why Should I Care About DeFi?

- DeFi is creating a system for better finance that is more transparent, more accessible, and more efficient. By eliminating intermediaries, the efficiency of sending payments is improved, cutting both costs and time.

- DeFi also provides access to finance with just an internet connection, mobile and some cryptocurrency. Users of any background can access vital financial services, whether it be deposit accounts or savings accounts, to insurance, investing, and more, whereas access to these services can be dependent on income or require sensitive personal information in legacy finance.

- Finally, DeFi is more transparent than legacy finance, since the smart contracts are written in open source code that can be audited by anyone. Any flaws quickly become apparent, in stark contrast to the traditional banking system, which is more like a black box. Also, the functioning of DeFi protocols is determined by decentralized governing organisations, giving ordinary people a chance to get involved and shape the future of these protocols.

What's the Potential of DeFi?

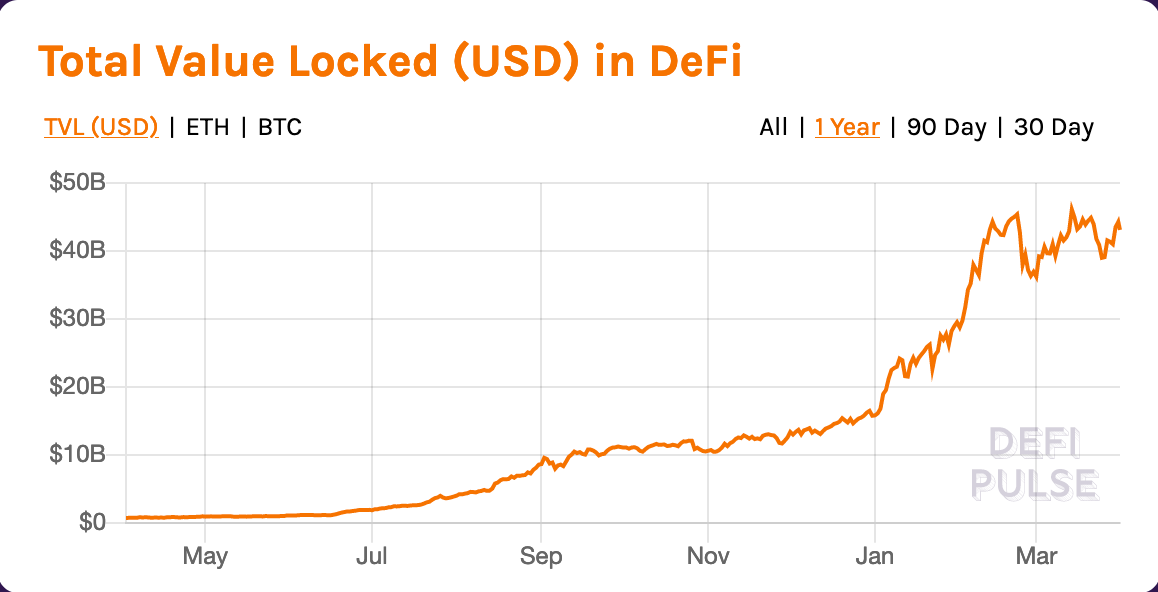

Collateral has to be locked into smart contracts to access the financial services offered by Decentralized Applications on Ethereum and other public blockchains. The Total Value Locked (TVL) is an important metric telling us how much is locked into DeFi, which has seen rapid growth (as shown by the chart below).In the past year, the total value locked in DeFi protocols rose from around $600 million to approximately $43 billion at present.

While DeFi holds a lot of promise for the future, it is still in the experimental phase and needs to be polished before gaining mass adoption. Nevertheless, the potential is huge: eating up the entire financial services sector.What are Some Examples of DeFi?

Stablecoins

Stablecoins are cryptocurrencies that are tied to the value of a fiat currency, such as the US Dollar or the euro, which together with cryptocurrency wallets can act as a useful replacement for a bank account. DAI is one such stablecoin (named after Wei Dai, the creator of Bitcoin predecessor b-money) and is pegged to the US Dollar where 1 DAI = 1 USD.While most stablecoins are backed by some reserves controlled by a centralized entity, DAI is a decentralized stablecoin collateralized by other cryptocurrencies (such as ETH) and cannot be confiscated, devalued or controlled by a single entity. Since DAI is also programmable, it has become one of the most popular assets used in DeFi applications. But how does DAI maintain the peg to the US Dollar?

Maker is a smart contract providing a decentralized platform for the creation of the DAI stablecoin. Maker and DAI have been around since 2017, before the term DeFi even existed. As a peer-to-peer collateralized credit platform, users can lock up certain cryptocurrencies (such as ETH and BAT) and generate the DAI stablecoin. We can think of it like a central bank that can be used to print your own money, but it’s fully backed and verified by the blockchain.

MakerDAO is a decentralized autonomous organisation that is in charge of maintaining the peg where DAI's peg to the dollar is related to another token, known as MKR. The MKR token is used to pay a stability fee, which acts like an annual interest rate for borrowers who want to mint new DAI, and also discourages inflation of the supply of DAI. Once each debt is repaid, the MKR stability fee and DAI tokens are both burned (i.e., they are irrecoverable).

The MKR token also serves as a voting share in the MakerDAO system, where users vote on changes that affect the smart contract's operation. The idea is that the value of the MKR token should increase if the MakerDAO is being governed well.

Lending & Borrowing

Decentralized lending systems in DeFi require a user to post some collateral (such as DAI or WBTC) to borrow some funds and provides greater flexibility for lenders, as they can earn passive income through interest payments.

The conception of Compound Finance, which is one of the largest borrowing & lending DeFi protocols today, took place in 2017 in the crypto market's previous bullish phase. What Compound does is create a reliable and secure system to enable cryptocurrency holders to receive an interest rate on their coins.

Different tokens can be supplied or used as collateral on Compound, operating as a liquidity pool built on the Ethereum blockchain. If you hold the supported cryptocurrencies, you can supply these to the pool and earn interest. Borrowers can take a loan from the pool and pay interest on their debt. The interest rates are derived algorithmically accounting for the demand and supply of the asset and are paid as soon as you deposit into Compound's smart contract.

Aave (which means Ghost in Finnish) is another money market protocol where assets are managed by smart contracts on the Ethereum blockchain. There's wider support for different cryptocurrencies in Aave as compared to Compound, with 17 assets available to borrow or lend.

You can deposit stablecoins like DAI and earn interest, draw a credit line against your deposit or delegate your credit line to someone else through a smart contract. Founded in 2017 as ETHLend, the original system matched borrowers and lender in a peer-to-peer fashion, before they adopted a pooling system.

In Aave, aTokens are issued, which represent the underlying asset borrowed, and these tokens enable lenders to get their interest paid out algorithmically. Holders of the native token of the system, AAVE, can get a discount on fees and borrow slightly more if they use it as collateral.

Decentralized Identity

Decentralized identity is a newer and developing sub-sector within DeFi that aims to allow users with little to no cryptocurrency exposure to build reputation and trust so that they can participate in decentralized lending protocols. With a decentralized identity solution in place, it opens up unsecured lending for lending protocols such as Aave and Compound.In this post, we've covered some of the more established DeFi protocols that are perceived to be safer. Smart contract security is vital for Dapps to function correctly and, while there are many opportunities in DeFi, there are also risks if you deposit money into a smart contract that hasn't been audited.

There's still some way to go before DeFi can go mainstream, especially in terms of scalability and user friendliness, as most users at the moment are technically savvy. But there is great promise in DeFi in making financial services more accessible and more inclusive than the legacy system.