The ten altcoins that increased the most in July are:

- Axie Infinity (AXS) – 629%

- DigitalBits (XDB) – 271%

- Flow (FLOW) – 173%

- The Sandbox (SAND) – 158 %

- Chromia (CHR) – 116%

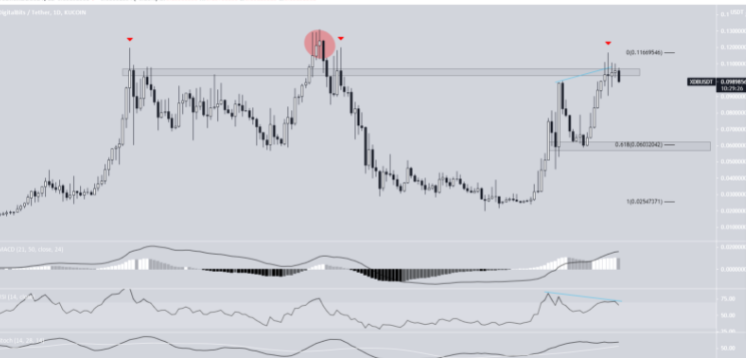

XDB

XDB has been moving upwards since June 26. On July 27, it reached a high of $0.116 and decreased, leaving a long upper wick in place. The rejection was important, since XDB is now trading below the $0.105 horizontal resistance area. With the exception of a deviation on May 5, all forays above this level have left long upper wicks behind (red icons). Furthermore, the RSI has generated bearish divergence. The closest support level is at $0.06, the 0.618 Fib retracement support level and a horizontal support area.

XDB

XDB has been moving upwards since June 26. On July 27, it reached a high of $0.116 and decreased, leaving a long upper wick in place. The rejection was important, since XDB is now trading below the $0.105 horizontal resistance area. With the exception of a deviation on May 5, all forays above this level have left long upper wicks behind (red icons). Furthermore, the RSI has generated bearish divergence. The closest support level is at $0.06, the 0.618 Fib retracement support level and a horizontal support area.

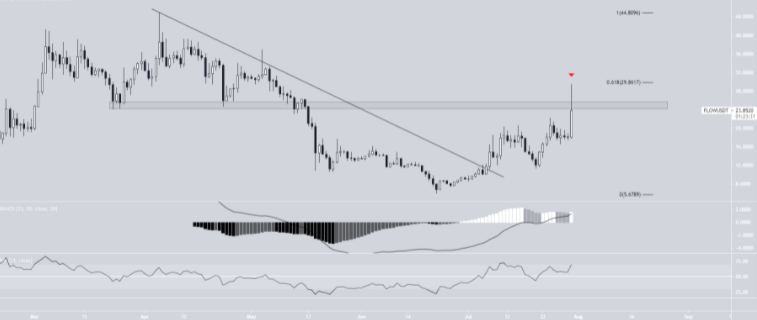

FLOW

FLOW has been increasing since June 22. On July 6, it broke out from a descending resistance line. It created a higher low on July 20 and has been increasing at an accelerated rate since. On July 30, the token initiated a strong upward movement and proceeded to reach a high of $29.43. The high was made right at the 0.618 Fib retracement resistance level. However, the higher prices could not be sustained and FLOW created a long upper wick (red icon). In addition to this, it has now fallen below the $24.50 horizontal resistance area. Despite the fact that the RSI & MACD are still bullish, the token has to reclaim this level in order for the trend to be considered bullish.

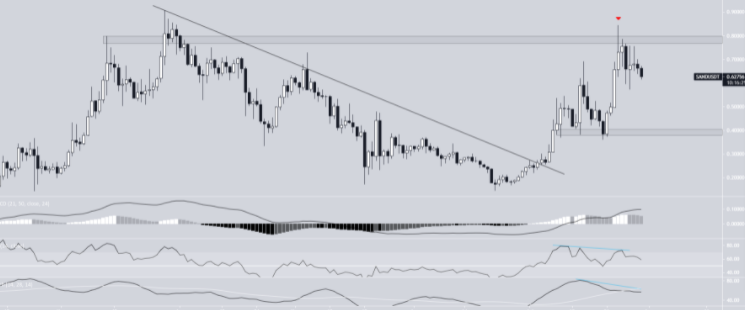

SAND

SAND has been moving upwards since June 1. On July 3, it managed to break out from a descending resistance line. This eventually led to a high of $0.845 being reached on July 24. However, the token decreased shortly afterwards, leaving a long upper wick (red icon) in place. The drop validated the $0.78 horizontal area as resistance. Additionally, the drop was preceded by bearish divergences in the RSI & Stochastic oscillator. The latter has now made a bearish cross. The closest support level is at $0.040.

CHR

CHR has been increasing since May 23. On July 22, it managed to break out from an ascending parallel channel and proceeded to reach a high of $0.41 three days later. It has been decreasing since, potentially returned to validate the channel as support. Technical indicators are still bullish, since the RSI is above 50 and the MACD is positive. In addition, the Stochastic oscillator has not made a bearish cross. The main resistance area is at $0.46.